-ORIGINALLY POSTED IN MARCH 2017-

As recently reported by http://bcsecuritiescommissionasham.blogspot.ca – it appears that the British Columbia Securities Commission (‘BCSC”) physically regulates corporations that they have physically invested into via their public sector pension and retirement operator (the British Columbia Investment Management Corporation (“BCIMC”).

On the website operated by BCIMC it states, “With a global portfolio of more than $121.9 billion, bcIMC is one of Canada’s largest institutional investors within the capital markets. We invest on behalf of public sector clients in British Columbia. Our activities help finance the retirement benefits of more than 538,000 plan members, as well as the insurance and benefit funds that cover over 2.3 million workers in British Columbia. Based in Victoria, British Columbia and supported by industry-leading expertise, we offer our public sector clients responsible investment options across a range of asset classes: fixed income; mortgages; public and private equity; real estate; infrastructure; and renewable resources. Our investments provide the returns that secure our clients’ future payments and obligations.”

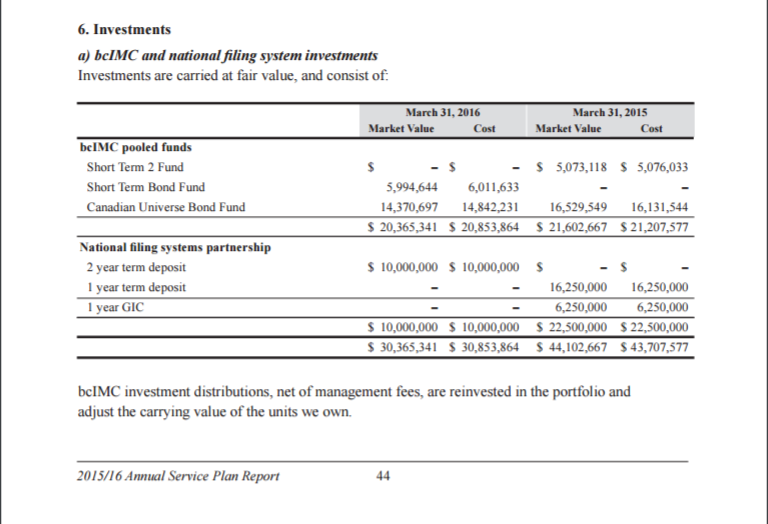

As you can see (below) in a portion of the BCSC’s 2015-2016 Annual Service Plan Report, we see that the BCSC holds just over $20.3 million in bcIMC investments.

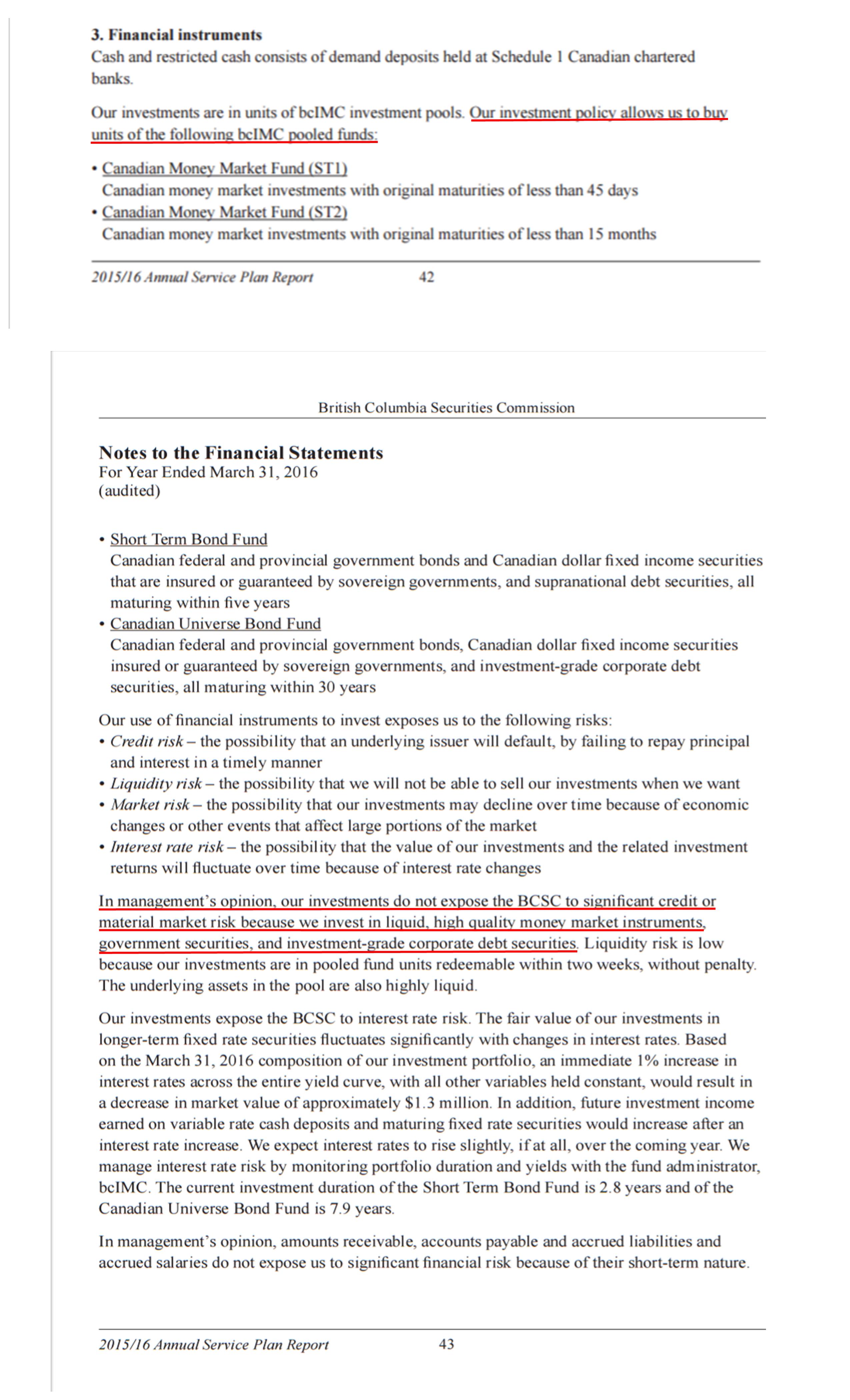

In the section below – again taken directly from the BCSC’s 2015-2016 Annual Service Plan Report (and supposedly written by Brenda Leong) the writer outlines the BCSC mandate with respect to their investments. One can immediately notice there is no disclosure that they regulate their own investments. In the wording (underlined in red) we can see they indicate “Our investment policy allows us to buy units of the following bcIMC pooled funds….” but again fail to acknowledge anything that can/and should be considered offside.

And in the underlined section above we see that in “their” opinion, their “investments do not expose the BCSC to significant credit or material market risk because we invest in liquid, high quality money market instruments, government securities, and investment-grade corporate debt securities.”

IS THIS BECAUSE THEY REGULATE THEIR OWN INVESTMENTS AND THAT THEY WOULD NEVER SANCTION COMPANIES IN WHICH THEY HAVE INVESTED?

Turning our attention now back to the bcIMC website, we have found their end of March 2016 Investment Inventory List (Click on link). At a simple glance, we see hundreds and hundreds of names of companies – some are well known and others many have never heard of. There are literally companies from all over the world and some are located right here in British Columbia.

Here is where it gets interesting, there are names on this list that the BCSC has battled (or is currently battling) as it combats securities fraud, mis-representations, excess fee’s violations and other regulatory issues.

But that is all fine – I imagine there will be people that say, “Who cares, I am sure the IF one of these companies committed some sort of a securities crimes or had some sort of regulatory issue – I am sure the BCSC would conduct themselves in a professional manner…”

Ladies and Gentlemen, I present to you the BCSC vs HSBC , known as 2016 BCSECCOM 185 – a matter that presented itself to the BCSC. It seems that a division of HSBC had over-charged their own clients excess fees “Due to inadequate controls and supervision, it did not apply this policy consistently, which resulted in some clients paying extra fees.” For their trouble, the Respondents (who’s head office is the Worlds’ 6th largest bank worth $2.4 TRILLION dollars) had to pay $300,000 CDN and costs of the investigation of $20,000. And they had to pay just under $7.1 million of the fees the OVERCHARGED back to their clients. CASE DISMISSED!!

It is important to look at the timing of this matter – it was during a stretch of time AFTER former Executive Director Paul Bourque was fired or quit and BEFORE present BCSC Executive Director Peter Brady was put into the position. You guessed it – BCSC Chair Brenda Leong approved this Settlement Agreement.

This definitely needs a closer look by a government watchdog organization! Why is there no disclosure in the BCSC financial overview that the public reads that they in fact regulate companies in which they have investments into.

Bizarre days indeed at the BCSC!

BCSC’S CHAIR BRENDA LEONG

BCSC’S CHAIR BRENDA LEONG (Source: mypersonaltrainervancouver.com)

(Source: mypersonaltrainervancouver.com) (Source: mingpaocanada.com)

(Source: mingpaocanada.com) (Source: cbc.ca)

(Source: cbc.ca)