-POSTED PREVIOUSLY-

What a last couple of weeks it has been for Walton International – the Alberta Securities Commission suspended Walton’s registration which prohibits them from selling any more of their investments. And then they hired Ernst & Young to take them through the CCAA process in an attempt to re-organize their debt. This sounds almost identical as the League Assets story we discussed last summer in this blog post. One can conclude the Walton matter will have the same ending! How can a company make hundreds of millions of dollars selling land be broke after 25+ years of being in business? Rumor on the street is the company is being gutted and those (at the top) have already cashed out their millions…

WAS THIS ALL PREDICTABLE?

Back a few years ago I came across a Sales Representative that worked at Walton International at a Calgary Flames hockey game. After chatting for a few minutes he suggested I look at his investment opportunity – it was a parcel of land down by Spruce Meadows (in the southern tip of Calgary). Although I was not interested in the investment, I agreed to meet with him at his office a short while later.

I remember their office being really nice and it seemed like they had a ton of staff. After receiving a brief sales pitch I was sent on my way with an envelope full of paperwork. Some time later, I opened the envelope and (as part of the package) discovered a letter from a lawyer named Donald Boykiw from the fancy Bennett Jones LLP law firm.

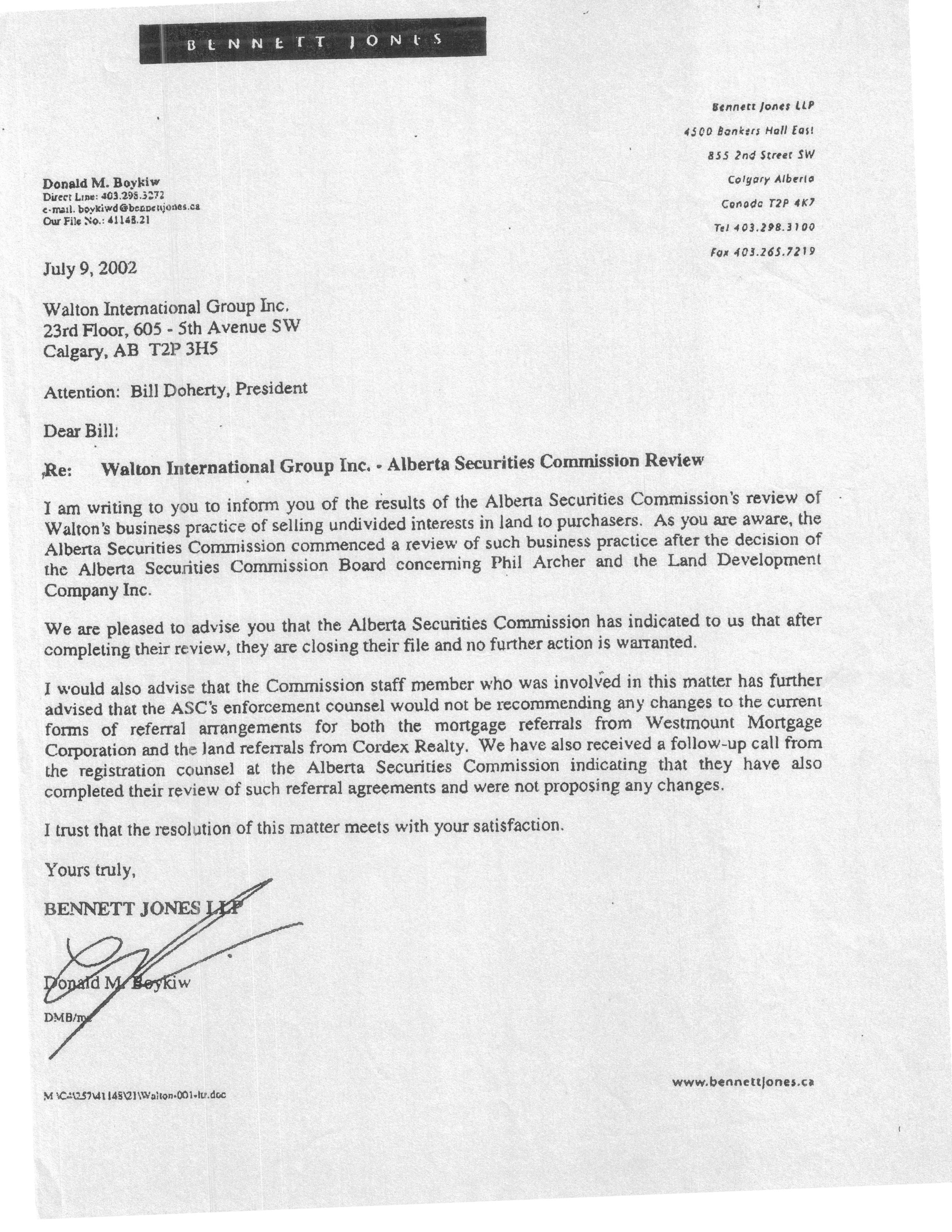

The letter is short and cuts to the point – it indicates that Boykiw is writing to inform Walton that the Alberta Securities Commission had reviewed Walton’s business practice of selling undivided interest in land to purchasers and that this review had been done as a result of sanctions against Walton’s prime competition in Alberta land banking. Boykiw goes on to state, “I would also advise that the Commission staff member who was involved in this matter has further advised that the ASC’s enforcement counsel would not be recommending any changes to the current forms of referral arrangements for both the mortgage referrals from Westmount Mortgage Corporation and the land referrals from Cordex Realty. We have also received a follow-up call from the registration counsel at the Alberta Securities Commission indicating that they ave also completed their review of such referral agreements and were not proposing any changes.” A copy of the letter:

The significance of this letter is simple – Walton International’s business model sees them allegedly buying farm land for as little as $400 per acre and turn around only days later and sell it for up to 7000% increases to investors from all over the World – and the gang down at the ASC gave them a clean bill of health while sanctioning others in the same line of work. And don’t forget – this happened during Ralph Klein’s duration as Premier of Alberta who’s daughter physically worked at Walton’s head office.

For those people that do not know who Walton International are (or were) – they purported to be the largest land banker (and then later land developer) in the nation. They had many projects throughout Canada and the United States. They had come under fire in some circles for paying huge upfront commission to their sales people and for having lavish spending sprees on chartered boats and trips for Staff. In one instance, it was reported they had chartered a large ship and had the expensive Self-Help Guru Anthony Robbins as a guest to get their staff motivated to sell their product.

Facts are – may people have been reporting on Walton’s demise for years. A simple google search has found us endless reports from press from all over the World suggesting Walton’s business plan had some distinct cracks and was leaking severally. An article in the Ottawa Citizen from March 2013 suggests the land banking project in Ottawa was in trouble.

What happened in Singapore when they had several complaints about many Land Banking firms – even Walton International? Out comes the huge Public Relations wheel and they brought an entire news crew to see their operations in Canada….

https://www.youtube.com/watch?v=sTzJ_61nY54

This video is so biased towards Walton but comes across as some bi-partial news telecast – We wonder how much more they raised after this video made the rounds…

Would this all have been avoided IF the ASC had not given them that clean bill of health back in 2002 – that they used as a sales aid for their sales people??? Shame on the ASC! This story is going to be huge when the cards ALL come falling down – and this letter is going to be used in any case against the ASC! How are they going to be able to protect the Walton Investors when they are complicit in allowing Walton to exist – even going as far as giving legal advice that their sales people used to close the unexpected investors?

I’m a Walton’s investor that bought into Walton’s in December 2007 for property in the US, Pichacho View which is located in Eloy Arizona. Fanny Fay issue in the states hit in 2008 which saw this investment stalemated for years.. In 2015 everything seem to be back on track with forward vision, Phoenix Mart highways etc etc. It appeared exit was imminent. May 2017 Waltons announces bankruptcy in Canada. I ask and they (Walton) state no affect to my investment in the States. That was a Lie, restructuring of all Walton’s land resulted in re-valuations of all the projects some were dollar for dollar of RUC shares, mine in particular where only valued at 20cents on the dollar.. fast forward out of bankruptcy their website appears to be dormant, no new exit information etc etc.. Their business plan was to build vertically and horizontally with dividend payouts yearly if not twice yearly. Doherty and clan of Directors have 100,000 shares each in the new company. There are 71 million shares out there with 710 million in assets..(Land) For me to re-coop my investment dividend checks in the amount of 10.00 a share per year for 10 years would have to be issued by Walton’s.. Something stinks here, this company I bought into because it was a Canadian based family company with Bill DOHERTY as the owner, their prospectus was 14 percent annual return on investment with 4-6 year turn time.. I’ve yet to receive anything and feel my investment is gone.. This company I feel has defrauded investors and should be looked at by the Alberta Securities Commission for Fraud.. Investors need to be paid back in some form….

Neil, let me first say I am very sorry you feel your investment is gone. This is never an easy scenario for anyone to go through. I am not sure what Walton paid for any of their land holdings in the USA but in Canada it was very much public record for a long time. I have friends in Asia (whom invested in Walton) that to this day still reach out to me and ask if I can help them ascertain what has happened to their investment dollars. Its a tough one – like I said in my post, Walton was trying back in the mid 2000’s to unload mortgages they had on their own properties. This to me was a major red flag – why would they be selling the paper of their own investments/holdings? It doesn’t make sense! It is some peoples opinion that Walton was a huge PONZI SCHEME that many people knew about – in that they had to bring in “new” investors to pay out the old. This was rumoured for a long time, specifically back in the late 90’s and early 2000’s as they did not have a lot of projects mature in the time frames they agressively offered.

The Alberta Securities Commission (in my opinion) won’t do anything to Walton. Like the BCSC, the ASC appears to be a “racket” and they would probably have to admit wrongdoing if they went after Walton. My reason for concluding this is that they appeared to give Walton a green light on many of their offerings – and as the letter in my blog indicates – they gave them a clean bill of health whcih their staff used as a marketing tool. The regulators are NOT allowed to give this blessing to any company – specifically if it is to be used to market their shitty land deals.

Neil, I wish things were different for you. But I do not see this ending well for the little guys – the big guys have already had their snouts in the trough for far too long.

RW

I also have been bilked by this firm. Are there updates on the class actions? Upon reading further it would seem that all is lost?

I am in agreement on all said here. I further believe we need to get a very good lawyer and take these thieves to court in a class action suit! If lost almost 80% of my investment as well and all of this through the greatest growth period in economics the world and North America has ever seen. It’s outright theft and mismanagement of their responsibility towards investors!

Gary Barber

barbergary@hotmail.com

I couldn’t agree more with his statement. I too, feel like I got ripped off and will never get my original amount invested back much less any profit even after 15 years. If there is a current civil law suit going on I would certainly be interested.

Walton International

This is a company I have dealt with for approximately twenty years or more. Initially they were very ethical and performed very well so for many years I was happy. This investment was primarily for raw land for which you received a title and held while the proceeded to get land approvals to where the property became ready for immediate development. The property was then sold in its entirety with all investors being paid out on their prorate shares. Then about nine years ago the government forced them to change whereby they were selling securities and individual investors purchased interests in the entire project. At that time Walton had a client base in excess of 90,000 that were regularly investing.

During this time Walton’s owners became billionaires from its activity but kept pushing forward getting ever bigger. After the market crash of 2007, things became very slow and Walton’s overheads were very high but never once did they mention there was a problem. Also during this there were relatively few properties sold and paid out. Walton tried many approaches to getting access to additional funds through existing clients or partnering but appeared to not be successful. During the last year before the problem surfaced and they defaulted, Walton indicated they would be selling and paying out in excess of $400,000,000 USD. In reality they ended up with about 10% of that. Those funds would then have been distributed directly to investors without further deductions. Under the new forced program RUC (roll up corporation) Walton owners are entitled to two separate commissions of 1% and 2% of the entire selling price in addition to receiving ample compensation for managing the company during the liquidation period.

In some of their communication after the default happened they indicated if we voted for the RUC option they would have many more tools at their disposal with which to make deals and recover our money. At one point, I was told they would recover 100% of our invested money and possibly a bit better but that we would not likely make much in the way of gains for having the funds tied up for nine years. That really hurt as I am in my seventies and on government pensions so was relying on this to enjoy my retirement. After the RUC was voted on and approved there was a barrage of other information much of it very unclear or confusing. Now that the dust is settling it appears that not only are we not going to recover what was originally invested but also the investments were made with USD but are being paid back in CAD and conversions do not seem to be accounted for or equitable.

What was done is that all properties were revalued into current market values and then prorated shares were allotted to each investor. The problem is that first of all they had accountants revalue all individual land parcels rather than a Real Estate Appraiser with specific raw developable land experience. Then it appears that some of the investors made money of the investments through higher allocated values while others seemed to be valued well below market. This was especially true in Arizona and Texas. In Arizona two years ago Walton sold a small portion of land in the Toltec development (the sale was for two acres of some of the least valuable land) and it sold for $90,000 USD per acre. The market in Arizona has since been fairly brisk and yet the rest of the more valuable land in the project was valued well below that number. Even common sense would tell anyone that this in not right. I know Walton has interests in many of the properties and am wondering if they have bigger interests in projects that got valued so high that they made money while others were valued far less below prices that were paid nine years ago but with recent sales showing a much higher value.

It just seems grossly unfair and unethical that owners who made so much from their clients should participate in what appears to be self-serving manipulation to enrich themselves further while devastating so many of their loyal clients. Try to get specific or more detailed information from them on specific questions seems impossible so I am hoping with your investigative abilities and connections you may chose to assist with something that could help more than 90,000 investors.

Since they Walton now seems to be even more self-serving I also have concerns that the land they are now selling off to return a small amount of investor’s investment, that such sales my involve a partnership, joint venture agreement or some other such benefit accruing to Walton’s benefit and to the investors detriment.

Should you wish to contact me for further information or any other assistance I can provide you may contact me directly at; 604-200-7417

Maybe a Fifth Estate or W5 investigation would be prudent in this case… frustrating. Dividend cheque’s to come next year?? In their Q3 they identify about 500 million in planned exits. That should be a return to investors of about 7bucks a share.. I highly doubt it.. time will tell with these folks.. as well I was suppose to get a T5013 for Capital gains/loss.. Guess what? although I took a 80 cents on a dollar bath they say my investment was in a Tax shelter so I’m not eligible ?? Love to see these folks in front of a Camera on a Sunday Night .. maybe.. we”ll see..

I dont think Fifth Estate or W5 will touch this as they are too “in bed” with the government agencies! too bad really as it would probably improve their ratings!

I agree! These guys should be in jail!! How do we get a W5 or someone else to investigate? Is there really no recourse on this at all? We all lost a lot of money. And what bothers me is that on top of that, we are also paying yearly management fees! And so the losses compound! How do we exit? I just want my investment back, or at least a portion of it. And I want to stop paying the annual management fees.

Hi Sonia, My name is Ramsay and have invested $189,000.00. Have you received any response from your request? I invested 10 years ago.

Tx Ramsay.

Anyone had news on the calgary northpoint 16 project? When can it be exited? Its been over a decade ( way past the projected exit timeline) since they were into this project.. Red flags all over!

Hi

I am currentley looking into the whole Landbanking Industry and I am interested in you comments. Please contact on enquires@specrim.com. Many thanks.

I was sold 60k as RRSP investment by Brian McKenna of Walton in Calgary in 2013 and 30USD as non-registered Walton silver Reef project.Now can I get anything back from CDIC??

I cant beleive I got sucked into their slick marketing back in 2006.

I thought I was smarter than that. When I said I wanted a shorter in investment than 4-6 years years all of a suddend it became only 3 years , after looking at some property in Texas that they said would be 12 years. The return rate was to be 20 % . It then took 2 months to confirm my purchase. My $75000 investment is now valued at $11000. $23000 was RRSP. They should never been allowed to sell registerd funds. I will probably die thinking how rich they are and hoping they all go to Hell . I am turning 73 in a few months . Great year retirement plan ! How do we get our money out these crooks who have made millions on our dimes ? With so many people who invested with them, is there no Class Action Law Suit going on ? I cant beleive I found this web site. With such kittle communication from Waltons I have been lost in the dark.

Please keep me posted. Ron Haddad 780-995-2300

Then I leave it to you to ask! Maybe we can spread the word to other walton investors???

We are also investors on Walton. We are looking for an update on what is going on and if we still could recover what we invested?

In the pdf under court orders there’s been a bunch of people taking action against Walton I’m gonna find the one I read already and post it for you guys to read .. the little guys won a couple rounds I’m thinking a class action lawsuit against Waltons and there hostile takeover .did anyone else figure out the ruc shares will never sell fully they don’t intend on becoming a issuer in any provice therefor you have to find a accredited dealer/investor that would buy the shares . I lost 140k so did my brother we are talking to a couple lawyers a out a lawsuit as they didn’t give is enough time to do our do diligence in the order it highlights there defaults .I will b updating it shorty hopefully

I invested over 200k in 2010 and have never seen any monies returned. Does anyone know any lawyers who are mounting any class action lawsuits on behalf of unpaid investors as I would like to add my name to the file.

Craig Bussey

craig.bussey55@gmail.com

Thank you for sharing , Ive lost my retirement savings as well , 12 yrs of smoke and mirrors. Can you please send me an update as well I would like to know how I can participate in any legalities against Walton , not sure how they can get away with bilking so many honest peoples retirement savings , a very devious company .

In the pdf under court orders there’s been a bunch of people taking action against Waltons….. look under

(Walton International Group Inc [CCAA Monitor)

Court proceeding .

.ruc shares will never sell fully they don’t intend on becoming a issuer in any provice therefor you have to find a accredited dealer/investor that would buy the shares . I lost 140k so did my brother we are talking to a couple lawyers about a lawsuit as they didn’t give is enough time to do our do diligence in the court order it highlights there defaults .I will paste the link soon

Hello I was going thru divorce proceedings in April 2009 and had to list the home thru a remake office in Coquitlam bc . I have never had to look after finances as my x wife always looked after that department . We sold the house and split our differences and done deal . While in the realtors office she introduced me to a salesman working with Walton International . I was depressed and vulnerable at the time of meeting the promoter. He had me so convinced in investing in two properties in the Peonex and Texas . He told me it may be to late to get in on the great deal supposed to exit in 3 to 5 years but he would make some calls to see if there was anymore room to invest in these two properties. The salesman cam back into the realtors cubical with a big smile on his face and told me of the good news. He said he could make it happen . We talked about amounts and by the time I left the building I found myself lnvesting 65,000 dollars of my half of the real estate deal. Now I find out it gone , I feel sick to my stomach as this was for retirement I am on disability living in an old park model trailer in minus 20 weather while the managers of Walton are eating steak and drinking Champaign on my dime . Thanks for reading

Steve,

I am sorry for everything you are/have went through. The sales tactic (you mention above) was actually called the “hook and release’ method and the sales people I know there were taught it from their managers. You get the prospect “hot” on buying the investment and then tell them it might be sold out. But then comes the good news and you are just allowed in “in the nick of time”. My best to you and hope you come out on the other side with a smile on your face. RW

Hi I’m from Saskachewan. I also took the hook for 26k wondering if there any similar posts from this province

I am not sure what you mean Terry? Are there others that invested in Walton that have contacted me?

This is what happened with Amble Way:

Total amount from investors, $US 18,228,520

The commissions were 13.25%

Offering Costs were 0.75%

Expense Reserve was 1.878%

Concept Planning was 1.835%

Recovery of Acquisition Costs was 0.931%

These percentages total 18.664% which leaves 81.336 % = $US 14,826,349 which was to purchase the land and provide profits for Walton.

The Land cost $US 4,054,602 and therefore Walton’s profit was $US 10,771,747

Note that Walton sold the land to investors for over 4 times what they paid for it months before; Walton put the profit (after minor expenses) in their pockets.

One may suppose that Amble Way is typical/average. Multiply $US 10,771,747 by the 140 projects and that is where all investors’ money went.

This was declared in the offering memorandums. The question is: did Walton sales men and women have a legal obligation to draw it to the attention of investors? Is there any investor to whom these figures were drawn?

Fred,

The only thing I will add is that they also allegedly had a mortgage company that then turn around and lent money to other projects and projects. One should really look hard into the Doherty’s and see where all the money went….how can he make that much money and then be forced into CCAA is the real issue here. Good Luck! RW

Bill Doherty took all the money out of the company and let it go into ccaa. He is a multi millionaire possibly even a billionaire, yet somehow our government lets them file some of their companies for protection. System in set up for corruption and unfortunately the investors lose.

We need to keep this going Waltons statements just came out and nothing forth coming for RUC shares,.. this needs to be investigated but we need numerous investors to actually get traction, you have my story.. how do we get together, this blog seems good but need to reach other investors.. I have doherty’s Email I have been emailing him and his cfo Kate.. lots of flowery language but still no money returned we need to launch a law suit/criminal investigation etc etc into Waltons they are still selling to Asian investors and this needs to stop, liquidate and get at least part of our investment back…

Does that mean none of the money in the RUC can be liquidated?

I just found this site and read the comments. I have my RRSP tied up in Walton as well. I would be more than happy to support any actions.

I invested $40K in 2008 in Arcade Medows outside Atlanta. I also was shown all of the previous high success returns and pretty much promised anywhere from 14 to 30% return on investment from between 4 to 7 years.

I’ve heard enough of their BS and truly believe we need to start a class action law suit. If I’m going to lose all I’ve invested, I’d at least like to see some justice from the courts, to the thieves that have indeed miss managed, and mislead all its investors!

It truly almost feels like a pyramid scheme the way all the early investors have seen the huge profits, which definable you came at the expense of people like myself.

I’m amazed that there has not been someone with a good legal background who has the wherewithal to take on these thieves.

Let’s get into it!

I am in British Columbia & also invested heavily in 2007 through a salesman with then Standard Life Financial (now Manulife). My initial investment was done under the rrsp umbrella for both Brant and Silver Reef – yes they put some bullshit note out about restructuring into Roll Up Corp & yesterday I received a statement from Vancouver company ‘Computershare’, another useless group, indicating to me that the value of these investments had gone from $ 46k down to $25k with the restructuring. I can’t even begin to talk about the fraud committed by these people over my non-rrsp investments in AZ Silver Reef Arizona.

For anyone wondering: Fraud is exactly what we are seeing here & sadly, while a class action against Doherty sounds appealing, I believe a criminal investigation at the federal level would be more appropriate as Doherty is worth billions.

I am in if others in this situation are interested in a unified approach and can be contacted at the following-sindi83@outlook.come.

By the way-securities Commissions in Canada are a joke.

Too bad about W5 and the CBC being the propaganda machine for the current gov’t as W5 was once a great investigative team & people enjoyed watching the show.

The federal police need to become involved.

Well, looking at the posts I see I am in good company in that I am not alone. Do any of you know of any concrete action being taken and how to proceed?

Hi does anyone have any further information on what’s going on with our investment? I’ve left messages for Walton to call me but no response.

we invested over 50,000 in the ambleway aswell back in 2009. i am sick over this. we own our own company and that was to go for our retirement!!

Where you from fred?? Send me an email or call me 6472210880

I invested $187,239.13 my total rrsp saving on the promise that I could withdraw in August 2018 my retirement date.

I have it on my initial agreement with a Olympia Trust Company. I tried to get info on my investment from Walton Group (Texas & Arizona) but was given very little information.

I have received all follow-up information stating my investment is worth $71,500. But I believe it is worth nothing. Also object to paying yearly charges.

Also checked with accounting firm if losses could be used as capital losses but they confirmed “NO”‘

CLASS action suit is the only option left.

Who told you that you could withdraw on your retirement date? Olympia Trust or Walton Rep?

RW

Good morning. I.We are in the same boat.Keep me posted

My sympathy to all of you who have been victimized by ruthless Owner/Managers and, as all have stated, have been re-victimized by various “Security Commissions”. It appears that we are all essentially in the dark and without much hope of any ROI nor any Justice. However…don’t give up yet on the media…they may yet step in on this travesty. May not return our retirement funds but may expose and possibly indite those responsible.

Is there not a single CHAMPION with integrity who can shed light on this…for the sake of all investors and for the reputation of Calgary.

The media is NOT on the side of these Walton investors – they are as corrupt as the regulators! And in some cases ever worse!

I’m sure they will get onboard just keep it coming…. I’ll send next to W5 and 5th estate.. My pension….

Hi there,

My husband invested $30,000 through some brokers about 9 years ago and he’s unable to get his money back. If anyone had information on a class action suit please contact me at lshum04@gmail.com

Thank you.

Please see following link

https://fraudalerts.nu/walton-international-group-inc/

Thank you for sharing John

We need to get together and find a a way to hold these people accountable in some way .

You have to be kidding me!!!https://fraudalerts.nu/walton-international-group-inc/

This definitely needs investigated.. Keep this going our ctc’s are inbedded. Who can start a website ??????

I too fell victim to this ponsy scheme when I invested in Walton AZ Sunland Ranch in 2006 at the urging of my Financial Adviser. She told me she recommended it, felt it was strong, and safe and a good investment and she was investing in it herself. Within minutes she had a broker in the office and I was signing over my entire RRSP fund. Even though I am a single woman – now 63, with no employer pension, no spousal pension, nothing to support me but CPP and OAP – but they both thought this was a good move for me. I wonder what she made from separating me from my RRSPs, what the broker made, Canada Western Trust (now Computershare) profited by “managing my funds” for 13 years now, Walton disappeared my entire retirement nest egg, and I have nothing. I am furious. I am sick and tired of these rich, financial predators fleecing people who are only looking for an alternative to the paltry tidbits the banks are willing to give out. Everyone is getting rich off the backs of the little guys who are often left with nothing. I would like to see a criminal investigation. I was told that each property was a privately owned and funded operation and that no property could be used to support the failing of another property. But that is exactly what they did. They took the cream off the top to line their pockets and simply “restructured” leaving us all with nothing while basically flippin us the bird and saying FU suckers as they jet off to their luxuriously well-funded retirement! Doherty and his whole slimy operation should be brought up on criminal charges!

Pam,

I am sorry to hear your story. I agree with you 100%! I hope things get better for you.

RW

Well Said ! Hard to beleive what they got away with it all for so long and then the RUC. ! ! ! How could they pull that off ????

I was also duped by slimy sales rep, Terry Haddock who successfully coerced me out $125K of RRSP’s in 2007. Had I left the funds with SunLife I would now be receiving RRIF payments instead of broken promises. I’m mad as hell.

Now that I’m 72 and could use the funds I’m left with nothing. These guys all belong in jail. This is another Bernie Madoff ponzie scheme.

Joke company, I invested in Highland Ridge Project in 2013 via a rep who was introduced by a friend who also invested. In British Columbia

Again same speech about 4-6 exit with 10-20% returns.. family company with great integrity…. lucky I was young and invested what I thought I would be comfortable losing… still sucks and slowed my ability to purchase my first home.

I have written it off mentally as it was invested through my initial pension but the icing on the cake are their annual fees despite the complete mismanagement of the company.

So sorry to hear some of the saddest stories above and hoping things will get better for all despite this awful experience with Walton. I am a Malaysian who too got into buying Walton’s Creekside, New Tecumseth 8 in Canada and Inglewood 1, all since 2006/7. Was just trying to check what happened to my investments. In 2016/7 I think their Singapore rep came all the way to Malaysia to make courtesy visits and tried to sell more projects, which I refused and insisted until I can see some money back from my existing ones.

Looked through Walton’s website and I can’t even see familiar names of projects I invested in on their list of projects which then prompted me to google further. And found this forum. Yep same sales pitch my a close girl buddy/ financial advisor when they briefly operated out of Malaysia… catch this, prospect investors were told that it is “capital guaranteed” and signed a seperate agreement which at that time seemed legit. So for me, it’s hard news to take after reading everyone’s plight above and I am all the way in this part of the world feeling really urghhh. Is there anything I can do to get back some money? I presume contacting the Singapore branch to enquire will lead me nowhere but into the thick of more BS. Pls provide any useful feedback.

My email is m.sweetooth@gmail.com, thanks in advance 🤜🏽🤛🏽

some things happened to us. We ( my wife and I purchased shares for the Texas and Arizona project back in 2009 ). After 10 years the market value drop by 85%. The problem is now we ( all of us who has this account hold under Olympia Trust ) will have to continue to pay the annual admin fee charged by Olympia. I don’t even know how to deal with this. Can you even just cut the loss and close the Olympia Trust account? Can we tell Olympia that I don’t want them to hold those securities anymore? I hope someone can give me some insight. Appreciate it.

I am in the same boat . Invested over $37,000 in 2006 in Phoenix Arizona project. Same speech , 4-6 years exit with 10% or more return.

Count me in for class action suit. Hopefully someone in this forum knows how to get one started.

My email: chachaboke@gmail.com.

Asian investor here. Invested in 2006. Was told it was a 4 to 7 year investment. 13 years later, we had an “exit offer”, our “undivided interest units” in the land is half the value of what we paid for

From Toronto, Lost $37,000.

Does anyone know of class action lawsuits?

Neil Armstrong,

Would you please advise whether there is any collective action to be taken in the shortest possible time?

Thanks in advance.

Hello , it seems very simple that a lot of good people have been preyed on an it seems there are no concrete ways to mitigate our way out of this theft of our retirement savings . ( they are still stealing my money through some arrangement with Olympia , some annual fee BS .) I am really tired of this insanity , is there any way to have this looked at in a law of court , for their obvious criminal machinations .

An article I found from ZeroHedge.

https://www.zerohedge.com/news/2019-06-13/retail-investors-bet-and-lost-billions-ghost-suburbs-were-never-built-0

I was sold Walton shares when I was young and naïve, along with 2 other investments (Carecana, Sincerus – anyone else?) All three have appeared to have been frauds all along. Its been 14 years now and it still haunts me. My heartfelt sympathies to others on here that have lost such sums of money and security. It is devastating.

Has anyone had any insight lately on Walton?

Hi I am from Malaysia. I invested in PINEHURST Canada 12 years ago in 2007. 1 week ago Walton informed us that after exhausting all avenues to re zone the land they are not successful in converting the land which remains as agricultural. They said this is because the Ontario government is very restrictive. So now Walton has received an offer from an interested buyer to purchase this agricultural land but at a big loss to us. For every 1 unit of c$10000 we are offered only c$4340 and c$950 will be deducted for legal fees so we will receive only c$3390. Effectively we are losing 66% on our investment after holding for 12 years. And then surprisingly on the same day Walton email us the voting papers we saw local Canadian news reported that the Ontario government has committed to cutting the red tape around zoning laws to free up vacant and valuable industrial land for housing.

We feel so confused by this and we are also wondering what is going on?

Should we vote to sell and cut losses. Is Walton telling us the truth. Is the buyer of our land genuine and are there inside information that our land will be re zone soon. Will it be turned around and sell off at a big profit after we have exited. What is happening? If anyone knows more please reply in this website

I put in $75K CD in dec 2006.(In Arizona)

Now valued at about 11k .

Please keep me informed of any class action suit.

Ron H. 780-995-2300

Edmonton

Hi everyone same story here, we invested in 2010 way to much.

All our Investment are in the States.

That is really something that bothers me too, that our original Investment we paid US Dollars for, got now converted into being paid in Canadian Dollars after the rollover into the RUC.

We went to that meeting in Calgary when we voted for that rollover, into the RUC. As a investor we had absolutely nothing to say on that meeting, everything was all forced on us and before we knew, the meeting was over. VERY FISHY!!!! There were only four investors there I was really hoping to see more of you guys there.

Maybe we can pray for a good outcome, keep us posted too.

Feel really sorry for some of you people that so badly relay on that money.

So sad… 4 investors only at the roll-up money-down meeting!! I guess we did not appreciate the tsunami coming towards us! I’m a medical professional, single woman, in MB, had been hooked up with Walton by my former BC financial adviser, as I read above (former Standard life, now Manulife). He genuinely believed in them. The agent in MB also truly believed in what he was doing, making his extended Greek family investing – and loosing – with W (can say he was later afraid for the well-being of his family). The bottom line is we need to get united and do something, not just tell stories. Walton will be soon moving in USA, and it might get out of the Canadian jurisdiction. I am a newcomer in Canada, don’t really know the system, but whoever can and know how to get them, please go ahead. Thank you in advance. Email: cstefano@shaw.ca

I want to see a class action lawsuit, now! It’s been since 2008 that I invested 40K Canadian. Every year, these thieves told me of the great progresses being made and that a closing deal was “just around the corner”. My email is barbergary@hotmail.com and would look forward to hearing anyone’s interest in making this happen. This is why people like Trump thrive in a world of trusting honourable people that they can so easily bury.

Gary Barber

The “Walton Group of Companies” website under the “Investor Information” tab has some updates. There is a notice dated January 2020 describing the RUC updates. It appears things are still in the works. Please go to: https://waltoninternational-my.sharepoint.com/personal/jsaomiguel_walton_com/_layouts/15/onedrive.aspx?id=%2Fpersonal%2Fjsaomiguel%5Fwalton%5Fcom%2FDocuments%2FJohn%27s%20OneDrive%2FRUC%20Update%2FRUC%20Update%20January%202020%2030JAN2020%2Epdf&parent=%2Fpersonal%2Fjsaomiguel%5Fwalton%5Fcom%2FDocuments%2FJohn%27s%20OneDrive%2FRUC%20Update&originalPath=aHR0cHM6Ly93YWx0b25pbnRlcm5hdGlvbmFsLW15LnNoYXJlcG9pbnQuY29tLzpiOi9nL3BlcnNvbmFsL2pzYW9taWd1ZWxfd2FsdG9uX2NvbS9FWEI4WlNUUzFPMU5qcVo3WldrbXNzOEJoeTVqcGZOUVl6S2hxcXUyQkViWnpRP3J0aW1lPU9OV2EzS3k1MTBn

I to am an investor (2006-$22,500 in the Edmonton Big Lake property). I am confused how the company continues to operate managing $3.8 Billion in assets (Walton’s website-2020), while 90,000 investors remain in limbo. I realize there are risks in investing, but usually companies go out of business when they go bankrupt. Hopefully, Walton’s continued operation will bring returns to those of us who invested over a decade ago. Reading through the comments on this blog does not reflect ethical business practices and makes one wonder how such a company can continue to operate putting more investors at risk. The Alberta Securities Commission should be held accountable if investors lose their investments.

I hear and sympathize with everyone who got taken by Walton myself included. I purchased over 100,000.00 my retirement income like a fool , in sawtooth az and amble way tx in 2007 with adamant promises from marv and judy cole that my investments were guaranteed plus interest paid back within 5 years. It is now 13 years of paying the yearly fees to olympia trust with no return. If there is any way of getting a class action suit going I am in.

Bea – I’m wondering why some investors are paying RUC fees to Computershare and some to Olympia Trust? Were you able to verify if you received a distribution in April of this year? Have you or do you know of anyone who has contacted the Alberta Securities Commission in regards to this matter?

You had an option to move your share holdings from Olympia to Computershare as part of the Roll up

Hi Tanya. I too got ripped off, 50k and am also paying yearly fees. The different companies it has been explained to me is if you invested with “registered money, I.e. rrsp” or after tax money( not sheltered) Either way, we are all getting ripped off.

Can you please contact me? My email is therealestategirl@gmail.com. I am trying to figure out how to stop Olympia from taking management fees.

Put me on record as a very unhappy investor. I had 30K (Canadian dollars) invested as an RRSP in the Sun Ranch project between Scottsdale and Phoenix. It seems like 20 years ago but it was more like about 16. The project was touted as a can’t miss being on an interstate halfway between Phoenix and Scottsdale and commuter distance to both major cities. It was supposed to double in 7 years max based on the performance of “every other Walton project.” What a sales presentation that was. My project was absorbed in the roll up company, something that was never adequately explained and seemingly crooked. The roll up company allocated about 17 cents on the dollar, maybe less. However, I just watched a webinar by Walton and they asked a real estate group to do a presentation on real estate prospects in the US post Covid. I was very interested to learn that the Phoenix/Scottsdale area has been a very hot market in US real estate is projected to continue climbing. Also, Walton is being paid millions and millions for various projects throughout the US on an option basis. I feel cheated. To add insult, Olympia Trust charges me trustee fees every year costing me even more money. They told me if I cash out that I would have to pay a bunch of income tax on money that wasn’t even there because my investment was registered as an RRSP. We need legal representation as a group and the ASC needs to be called out as well.

From Vancouver, Lost $20,000.

Please count me in for the action lawsuits?

miyee1129@gmail.com

I am in 100% agreement that a class action suit is required. I’ve lost over $30,000.00 of my 2008 investment of $40K.

All of this happened during the greatest climbs in North American real estate as well as the growth of the economy. Absolute thievery this has become. After having no choice but to agree to the RUC garbage, they have absolutely no information (which I’ve requested multiple times) on how I can expect growth or liquidation process of my funds.

WE NEED A LAYWER PEOPLE! Surely one or many of the investors are lawyers and could provide a little help and guidance? We must take action and stop this nightmare asap.

Gary Barber

I have lost almost $400,000 CAN to Walton, that was my life savings, it was money that was to look after me for my senior years. My adviser got me involved in 2006. In 2007 I received approximately $72,000 CAN. for a partial sell of a property. My financial adviser advised me that $65,000 will be put back into Walton, while the balance would be put into the holding company to pay their fees for holding my money. The total investment was then $465,000 CAN into Walton. Being as naive as I am I trusted my adviser with my life and signed whatever when I was told. I never received a cent after that, inspite of being told that there were to be exits coming up numerous times. With everything being turned over into RUC shares, my investment fell to $162,756 CAN. I was told that I cannot take any of that money out of Walton, unless I find someone one else who would purchase it from me, but who would be stupid enough to purchase it from me, when they cannot access it. So, I have lost pretty well my whole investment. I am devastated, I am left to live only on my OAS, CPP, and my small pension from my Employer. which amount to about $2200.00/month, which covers my utility expenses, medical expenses, groceries and insurance expenses. I had even contemplated suicide, but I can’t let Walton win.

Please count me in for the action lawsuits.

My financial advisor got me involved with Walton in June 2006. I trusted him with my life and just signed whatever I was told to sign. He knew that I knew nothing about investing money and left everything up to him. My total investment with Walton was $465,000 CAD for 46,500 shares at a value of $10.00 CAD each. These were called predevelopment holdings. This was as of April 10, 2018.

Then later in t2018 all shares were turned over into RUC (Roll Up Corporation) shares and the value dropped to $153,310.00 CAD, (15631.000 shares at $10.00/ share) To date I have lost a grand total of $325,284.96 with Walton International. What I have left of everything is $140,216.04. which I cannot access or even get back. I feel this is a ponzie scheme as Walton is still purchasing properties and hiring people when they can’t pay back their initial investors their money. All I want is my original investment of $465,000 back. That was to look after me in my senior years, I am now 70 years old and only have my pension cheques and Old Age

I just came across these posts. My husband and I invested over $200,000 with Walton in Canada in 2005. When RUC was created held 219,995 shares worth $10 each. The recent audit shows that the loss is more than $40,000 and the shares are worth $8. I became a widow in 2015 and it is only now that I am finding out about Walton. Through a very bad financial advisor I

We lost over $200,000 Canadian. How can these guys get away with this. Is there anything we can do.

Has anyone refused to pay the yearly fees. If so what happened

i bought 400k WALTON WESTPHALIA shares, $10 per share, now it is 0.01 per share! how can I get money back.

My family and I have invested into different investments with Walton as well. Is there a class action happening now? I found this lawyer online but not too sure if she can help? http://www.investorfraudsite.com/.

I invested $197,000 in Walton Group (land holding all in the states), I was told by restructuring that it would not effect my investment. Upon receiving there first re-evaluation it was downgraded to $70,819 with a slash of the pen by the accountant firm. Also spoke to Walton Group and basically told there is nothing I can or the are willing to do. Basically I consider this a loss which cannot be used for anything (taxes etc.).

Olympia you manages my investment continues to charge me $400. yearly to maintain RRSP account. I have tried to reduce fees with no results.

I am willing to enter class action suit against Walton and Olympia. The are both milking the system and investors as much as they can with no end in sight.

My wife and I invested $50000 in Walton International in 2010. It was supposedly for projects in the Atlanta Georgia area and it Dallas ? Fort

Worth. Like all of you we have not received anything from this investment. Count us in for a class action suit.